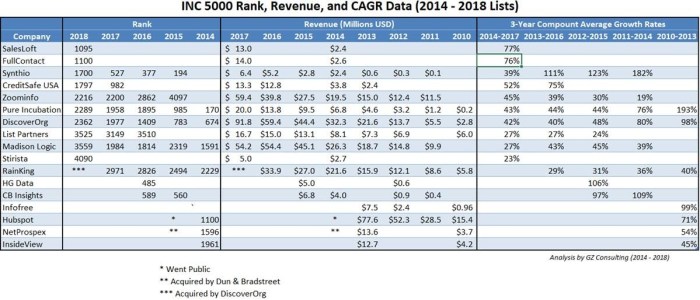

Several sales and marketing intelligence firms made the 2018 Inc. 5000 list including DiscoverOrg, Zoominfo, and FullContact. Signaling difficulties in the predictive analytics space, no firms from that category made the Inc. 5000 list.

Inc. magazine lists the top 5,000 US firms based upon three-year revenue growth rates. Eligible firms must have at least $100,000 in 2014 revenue and $2 million by 2017.

Zoominfo made the list for the fourth consecutive year, with revenue reaching $59.4 million and a three-year CAGR of 45%. Zoominfo grew its headcount by 50% between July 2017 and July 2018 and raised its customer base to 8,000 enterprise customers.

“The Inc. 5000 is the measuring stick for successful, high-growth, private companies,” said new Zoominfo CEO Derek Schoettle. “Since joining ZoomInfo earlier this summer, I’ve seen the tech innovation and the business demand for trustworthy customer data that makes me confident that ZoomInfo will continue to make this prestigious list for years to come.”

Zoominfo added over 100 staff and 2,000 customers in the past year. At their June Growth Acceleration Summit, VP of Corporate Development Phil Garlick attributed the firm’s success to hard work, teamwork, sweat, and tears.

SalesLoft made the list for the first time as the firm caught fire after launching their sales engagement platform a few years ago. Revenue grew at a 77% three-year CAGR to $13 million in 2017. SalesLoft also placed seventh on the most recent North American Deloitte Fast 500. The Atlanta-based firm recently acquired NoteNinja to integrate its meeting intelligence software into the broader set of SalesLoft sales engagement capabilities.

CEO Kyle Porter is “excited” to “empower” his customers in delivering “a better sales experience. Buyers around the world are recognizing the differentiated benefits of purchasing products and solutions from sellers who use SalesLoft.”

Other first-timers were identity resolution vendor FullContact (76% three-year CAGR to $14.0 million) and data hygiene and enrichment vendor Stirista (23% three-year CAGR to 5.0 million).

“Marketers, product professionals, and data analysts have had a lot of success using FullContact to enrich the data that exists in their CRM, marketing automation, and other databases,” said Scott Axcell, VP of Marketing at FullContact. “From audience insights to customer care, there is no shortage of use cases for accurate, enriched customer data.”

FullContact acquired Mattermark and its company and event database last December to complement the FullContact people dataset.

While Madison Logic once again made the list, their growth stalled with revenue declining $200,000 last year to $54.2 million. Their three-year CAGR was 27%.

“We achieved this honor through the strength of our team and success of our customers. Our platform, ActivateABM, helps the most innovative global companies accelerate growth by converting top prospects into customers. By integrating directly into the martech stack, we can deliver solutions that are simple, strategic and entirely ROI-focused,” said Tom O’Regan, Madison Logic’s CEO. “We are thrilled to be recognized for the sixth time and proud of the momentum we’ve achieved on our mission to make the B2B marketer the driving force for growth and change in the enterprise.”

CreditSafe USA made the list for the second time, growing revenue to $13.3 million last year with a three-year CAGR of 52%. However, most of the growth was in the first two years with 2017 revenue only growing $500,000. The firm has over 100,000 subscription customers, 10,000 in the United States.

“Our team is extremely humbled to be included in such an elite group of high-growth companies,” said Matthew Debbage, CEO of Creditsafe USA and Asia. “When we established here six years ago, there was one large entrenched player in the business credit space in the US, so we felt our success was far from a sure thing. This recognition really helps put our hard work into perspective.”

“Being the younger, more nimble and tech-friendly player in the space has given many advantages as we strive to provide exceptional value to our customers,” continued Debbage. “We know that if are going to disrupt the industry, then we’d need to out-hustle our competition each and every day and really want to thank all those customers who’ve taken a chance on us.”

CreditSafe primarily provides credit data in the US, although they did enter the US and UK sales intelligence market a few years ago with Sales Joe. CreditSafe financials and filings are at the core of several European product lines including DueDil.

CreditSafe maintains offices in eight European countries, Japan, and the United States. The company serves the credit, collections, sales, marketing, and compliance functions.

Private company profiler Pitchbook is no longer eligible for the list as they were acquired by Morningstar, but the firm disclosed a 60% CAGR since 2009. They have grown their user base from 11,000 to 18,000 since the end of 2017. Since the beginning of the year, Pitchbook has grown from “just over” 600 employees to 908.

Finally, Pure Incubation made the list for the fifth year in a row posting a 43% three-year CAGR on $20 million in revenue. The Massachusetts demand generation firm offers data and marketing services for the medical and technology sectors. Products include PureB2B (Content Syndication and Intent Marketing), PureMed (Healthcare Providers and Facilities Database), ProspectOne (B2B Intelligence and Data Services), and Demand Science (Philippines-based Back Office Marketing, HR, Seles Development and Engineering Services).

Pure Incubation’s consistent growth “is another testament that we are building a strategically relevant and innovative company in the demand generation space,” said Chairman Barry Harrigan. “Pure Incubation’s continued placement on the list is not something we take for granted and we are going to keep pushing to appear again in 2019.”

DiscoverOrg made the list for the eighth-straight time. I covered their achievement yesterday.